SAP vs Salesforce... A CRM Review and Comparison

Simply put, customer relationship management (CRM) platforms help any size of business intelligently  store and manage customer and prospect information. Not only do CRM systems store customers' and prospects’ contact details but they also track all the touchpoints with a sales rep as well as keep tabs on the stages of deals with concise background notes. For that reason, the benefits of CRM systems go beyond only being a centralized place for storing data, they create a communicative, productive, and scalable environment for salespeople within organizations. Additionally, according to a LinkedIn survey, more than 91% of sales professionals say that they are using such technologies to shorten lengthy sales cycles, close bigger deals and grow their revenue, while 90% of sales professionals report that sales technology is either “important” or “very important” for closing deals.

store and manage customer and prospect information. Not only do CRM systems store customers' and prospects’ contact details but they also track all the touchpoints with a sales rep as well as keep tabs on the stages of deals with concise background notes. For that reason, the benefits of CRM systems go beyond only being a centralized place for storing data, they create a communicative, productive, and scalable environment for salespeople within organizations. Additionally, according to a LinkedIn survey, more than 91% of sales professionals say that they are using such technologies to shorten lengthy sales cycles, close bigger deals and grow their revenue, while 90% of sales professionals report that sales technology is either “important” or “very important” for closing deals.

While today, we see lots of players in the CRM technology field, it is important to not lose sight when deciding on where to spend your CRM budget. Among a slew of capabilities provided, many industry veterans suggest focusing on these four key enterprise offerings: Sales Force Automation (SFA), customer service and support, digital commerce and marketing automation. In the market, Salesforce, SAP, Oracle, and Microsoft, aka the big four, are continuously beefing up their CRM platforms to address these four areas in the most effective way. In the light of those four areas, this article will compare Salesforce and SAP through a rundown of their market position, key features, pros and cons, and pricing.

Before delving into the comparison between the two, I would like to briefly explain what a cloud-based pricing model means for those who are not familiar with the term. A cloud-based pricing model is applicable for systems with a cloud deployment model, also known as Software-as-a-Service (SaaS) or Web-based software, hosted on the vendor’s or service provider’s servers. Users access the software through any device that is compatible with the system and has an Internet connection. Traditional enterprise software vendors like Microsoft, SAP, Oracle, and IBM still have a huge base of on-premise software customers and they are all now pushing to aggressively convert those customers to a SaaS-based consumption model.

Where do SAP and Salesforce Sit in the SaaS Market?

Due to its reduced upfront costs, flexibility and easy implementation, the entire software industry has seen a cautious shift towards cloud-based implementation and the SaaS (software as a service) model in recent years. In fact, Gartner estimates the annual global cloud IT market revenue will grow to $390 billion by 2020, implying an annual growth of 17%.

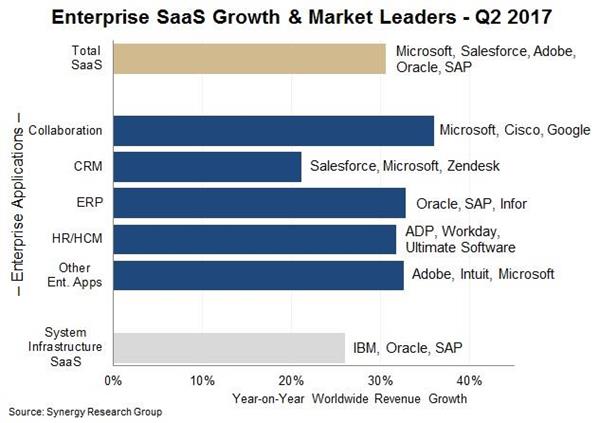

The Synergy Research Group, on the other hand, revealed data from Q2 2017 showing that the enterprise SaaS market grew 31% year on year to reach almost $15 billion in quarterly revenues, with collaboration being the highest growth segment. Microsoft remains the clear leader in overall enterprise SaaS revenues, having overtaken long-time market leader Salesforce a year ago. The main factor behind Microsoft’s SaaS boost is thought to be its acquisition of LinkedIn. However, in the CRM segment, Salesforce still persists to dominate the market.

Gartner disclosed that worldwide spending on CRM software totaled $26.3 billion in 2015, dominated by Salesforce ($5.17 billion), SAP ($2.68 billion), Oracle ($2.04 billion) and Microsoft ($1.14 billion). Salesforce’s early adoption of the cloud-based CRM has provided it an upper hand, and as a result, the company has doubled its market share since 2010, and stood at 22% in 2016, measured Forbes. "Salesforce makes up one-third of the overall market, so they're the 800-pound gorilla in the space," said Katie Hollar, Capterra’s director of Marketing. In the meantime, SAP’s market share fell from around 15% in 2010 to around 11% in 2016.

What Has SAP Been Up to?

SAP’s relatively later entry into cloud-based business is largely the culprit behind the recent market share losses. However, after the acquisition of Hybris in 2013, the company realigned its strategy to go up against Salesforce. Now, the momentum has been growing again for the products since establishing the SAP Hybris Service Cloud brand a year ago.

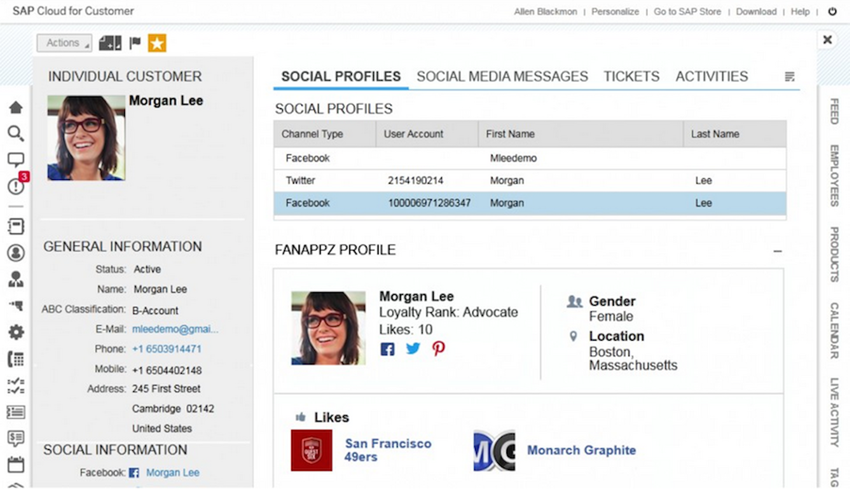

Before that acquisition, most of the services offered by SAP were on-premise but with the completion of the product integration, SAP, now fully embraces the cloud with a variety of flavors of its Hybris platform for different domains, including Hybris Sales Cloud for sales, Hybris Service Cloud for customer support, Hybris Commerce for digital commerce and Hybris Marketing for marketing. On top of this wide selection, the vendor’s successful ERP capabilities and strong BPM support place SAP Hybris Service Cloud on every enterprise technology buyer’s shortlist when considering a CRM in the process-intensive industries, including banking, insurance, telecommunications, and medicine.

SAP has also launched a new microservices-based architecture called SAP Hybris as a service. The SAP Hybris Cloud suite can run on SAP Hybris as a Service, (also known as YaaS). According to SAP, YaaS helps businesses rapidly and easily augment and enhance their existing solutions with microservices and software-as-a-service applications. Shortly, we will get into how users have reacted to these products so far.

For those who don’t exactly know what microservices-based architecture means; when you need some sort of flexibility to launch cutting-edge apps that engage your customers on any device without sacrificing security and without breaking your budget, you need to decompose a monolith application into smaller, manageable services which are called microservices. The idea behind microservices is to build apps as suites of independently deployable services so each capability (report generation, document management, customer relations) can be treated as a separate process.

What Has Salesforce Been Up to?

Salesforce has clearly adopted a wide and enthusiastic user base by leveraging cloud, artificial intelligence and machine learning. As you may already know, last year, the vendor was famously on an acquisition spree as the company acquired Prediction IO (machine learning), Metamind (deep learning), Implisit (data automation), BeyondCore (machine learning), Krux (data management), Quip (team-based productivity), and Demandware (enterprise cloud e-commerce – now Salesforce Commerce Cloud). More importantly, Salesforce didn’t waste any time putting these new technologies to use in an effort to blow the competitors’ technologies completely out of the water. Throughout this year, the CRM giant has continuously announced a slew of new products and new enhancements to its existing products. For instance, with its newly announced three key initiatives; customization, low-code orchestration, and using data as intelligence, the vendor opens up the Salesforce platform to even more new users and helps existing users get more out of the Salesforce products they're already utilizing.

Looking out over the horizon, thanks to this continued product development as well as the forecast indicating that 62% of overall CRM revenue will be cloud-based, Salesforce’s market penetration doesn’t show any sign of slowing down while SAP is still in the stage of development when it comes to AI and cloud-powered solutions. Aside from the supremacy battle between the vendors, what is important for your enterprise is what these leading vendors have to offer when deciding where to spend your CRM budget. They both are considered leading vendors in the market for differing reasons, similar to how every enterprise has differing needs and reasons for their existence. Based on the criteria in which your business may seem more beneficial is the right way to choose the right CRM for your organization. To make that decision making process smoother for you, here are what they have to offer:

Salesforce CRM and SAP CRM Comparison

Sales Force Automation

Although SAP and Salesforce are offering almost similar capabilities in this area, SAP’s really tight integration with its well-known and robust ERP system gives a competitive edge to the vendor in the cases that the CRM buyer is already utilizing SAP products for ERP. Because of the ability to easily integrate SAP Cloud with an on-premise SAP ERP/CRM, thanks to the middleware already available to SAP Cloud for Customer, Hybris Sales Cloud for sales is more appealing to users who already have an SAP ecosystem. In the case of Salesforce, the adapters should be developed to perform the integration between Salesforce and on-premise SAP ERP.

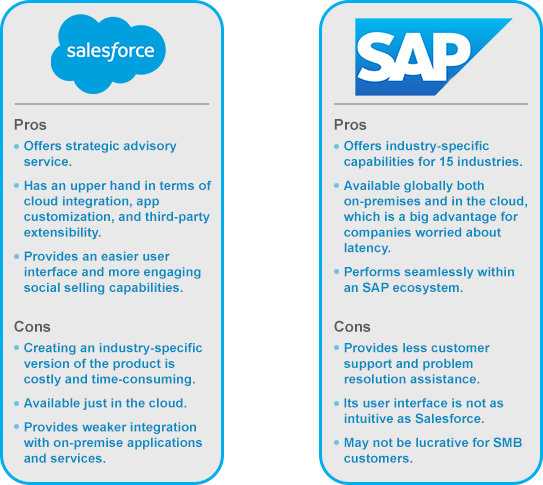

SAP has lately made numerous enhancements to all functions in the cloud, including sales, marketing, service, and delivery. For now, Salesforce certainly has an upper hand in terms of cloud integration, app customization, and third-party extensibility, but with all those enhancements, SAP won’t be so far behind in the cloud anymore. It is important to note that choosing an ecosystem is not a binary decision for companies, not like everything goes to a cloud or everything is on premises as it is very much a hybrid approach today. With this in mind, SAP’s ability to integrate with on-premise on top of its unprecedented growth in the cloud actually positions SAP in an even better place than Salesforce for those who use a hybrid (cloud and on-premise) environment.

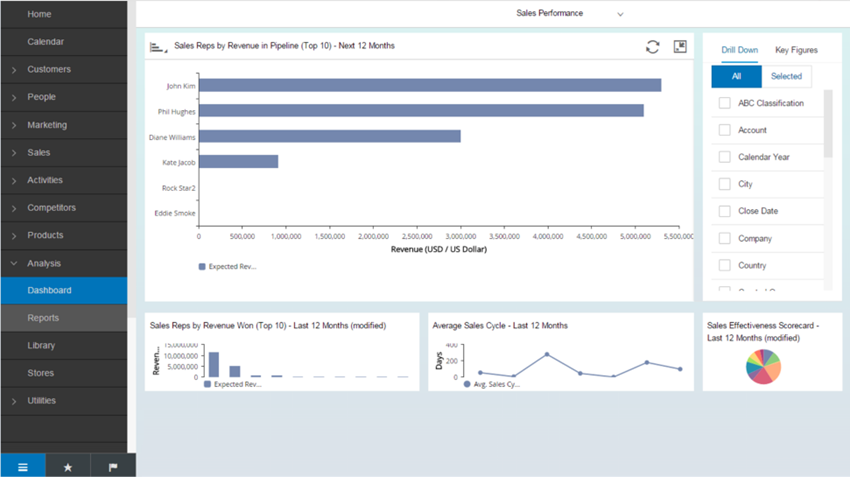

When it comes to a cloud-based ecosystem, though, Salesforce has an advantage especially with its easier user interface and more engaging social selling capabilities. According to the feedback from users, SAP is not known for its intuitive user interface, whereas Salesforce has been receiving many accolades for its ease of use. Salesforce is very user-friendly even for those who don't naturally use technology tools much. There is certainly a learning curve for both software but the one for SAP seems to be steeper than Salesforce Cloud for Sales, its flagship CRM product. I, for one, have found Salesforce easier to use than SAP based on my experience with both platforms as an account executive. My personal experience with Salesforce Chatter, for instance, was very rewarding as it is extremely easy to learn and use. One of the reasons that I found that capability extremely easy is probably the fact that Salesforce took a page from Facebook’s book and built a Facebook-like interface to make it familiar and relatable to all the age groups. Given we now have, on average, four generations working side by side in an organization, it's no wonder why Salesforce’s approach to usability pays off well.

Additionally, Salesforce’s the Lightning Experience, which comes first to the Sales Cloud, has been built from the ground up with feedback from thousands of customers. The Lightning Experience combines a new user interface with best practices that enable salespeople to work faster and smarter. In addition, Lightning has at least 25 new features designed for how salespeople sell. "With the reimagined experience, Salesforce Lightning enables users to work quickly and efficiently, with a modern, consumer-like experience to a range of devices, from a desktop computer or tablet to an Apple Watch," said Sean Alpert, senior director, Product Marketing, Sales Cloud, Salesforce.

However, what SAP is well-known for is the fact that SAP offers a lot of industry-related components and solutions, along with CRM solutions, while Salesforce merely targets CRM-based solutions. Moreover, it can be very time-consuming and expensive to arrive at an industry-specific version of the product with Salesforce. Especially after all the enhancements made to SAP Hybris, the platform became more globally presentable. Salesforce, on the other hand, is still limited to build and support a global-class B2C CEC product. Also powered by SAP HANA, SAP Cloud for Sales and SAP Cloud for Service use predictive models and analytics to provide users with actionable information whenever they access the systems. This is backed up by industry-specific capabilities for 15 industries. "The user expectation on a mobile device is completely different than what is expected on a desktop," said Volker Hildebrand, vice president of Strategy, Customer Engagement and Commerce for SAP and Hybris. "Companies should evaluate the full mobile experience of CRM systems as part of their due diligence to ensure that they get maximum adoption, especially by sales professionals who are now relying on mobile." Another disadvantage of Salesforce that larger organizations in heavily regulated sectors face is the complexity of maintaining third-party components for industry-specific implementation as Salesforce provides releases too frequently.

Customer Support

Gartner cited in a report: “Salesforce customers see the vendor not just as a CRM software provider, but as a strategic advisor on how to innovate and grow their business overall. This is a rare position of trust that very few competitors can match.” For SAP, the general perception is that the customer support eventually solves the issues but the only problem is that it takes a little bit more energy and time to get to that point, comparing to Salesforce. Nevertheless, the self-help portal, knowledge base, and live chat are included with annual maintenance and support contracts. A customer claimed that SAP CRM configuration documents are not readily available for all modules. For non-technical queries only, there is 24/7 toll-free, worldwide support available to SAP customers.

The Salesforce team, on the other hand, does not only respond timely but also follows up to ensure the user is not encountering the same issue. However, for development objects and business process adjustments, it is recommended by seasoned customers to get involved with a 3rd party Salesforce consulting partner. Online case submission with two-day response time is included in the subscription fee. Unfortunately, to get prioritized or an extra support such as a code to manage workarounds or faster response time (within 1 hour), you need to sign on for premium admin support, which is perceived mostly very useful but costly. A dedicated success representative can be purchased and available to those spending more than $1million annually. Also, Salesforce customers need to pay 12-15% of their subscription cost for phone support.

Marketing Automation

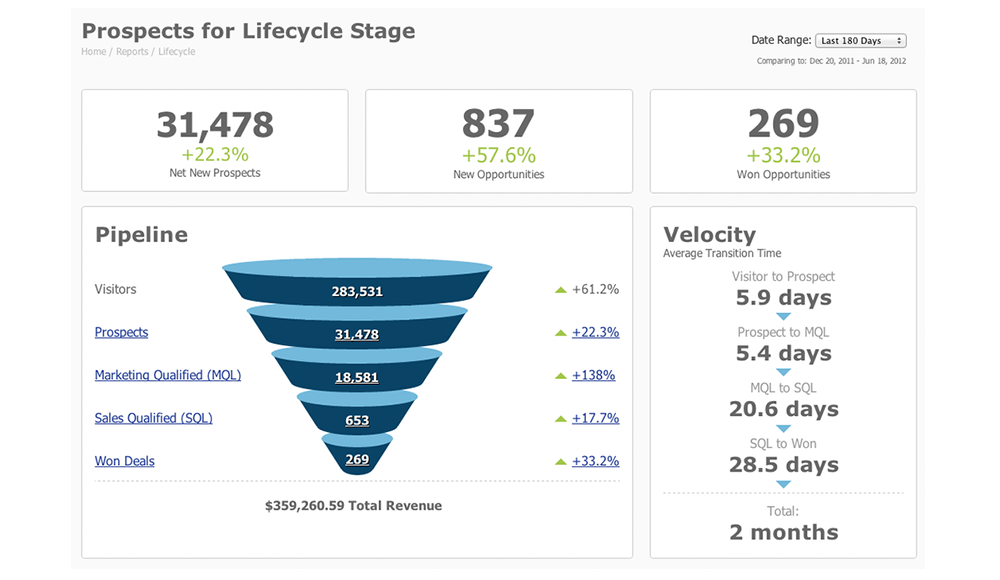

Salesforce has made so many enhancements to the Salesforce Marketing Cloud based on its recent acquisition of Krux, a data management platform (DMP), and its artificial intelligence software, Einstein. According to Salesforce, Krux interacts with more than three billion browsers and devices, supports more than 200 billion data collection events, processes more than five billion CRM records and orchestrates more than 200 billion personalized consumer experiences. Krux also differentiates itself from the traditional platform as it analyses and measures the engagement of customers across different channels to make recommendations to marketers, instead of associating a cookie with an audience segment which is how traditional data management platforms work.

One of the data-driven advertising tools Salesforce rolled out was cross-channel ad delivery management which provides the optimal ad frequency range for marketing campaigns based on testing and measuring the engagement level of the ads. Once an optimal frequency has been reached, ads can be turned off. Another fairly new similar capability is targeting digital advertising activity by drawing from all data within Salesforce, such as data from Marketing Cloud, Commerce Cloud, Service Cloud and Sales Cloud. To put this into perspective, with this insight, a marketer can always turn off ads to a specific customer when they have a current service issue because there is nothing more impulsive than seeing a promotion about the company when you are experiencing an issue with them. However, it shouldn’t necessarily be associated with only negative activities. When you know customers purchased your product, for instance, you can turn off ads to those or you can retarget them with a campaign for complementary products. As a result, this type of targeting definitely improves customer interactions.

Einstein Journey Insights dashboard is another well-received feature which uses hundreds of millions of data points to track consumer behaviors from the perspective of leads to buying decisions so the marketer can find the most influential way of conversation. To put it into context, again, a marketer can find out that a customer who received an email first, read an article that reviews the product second, and then watched the video, giving the marketer a better understanding of what increases a customer’s likelihood to make a buying decision. I believe there is a very strong value in understanding what sequence of events leads customers to buy or not to buy the product.

Once again, if you already use SAP BW it may be challenging to use Salesforce for marketing automation. In that case, SAP may help better to utilize complex segmentation around your transactional data, integration with SAP BW. Budget planning, tracking marketing spending, funds management & tracking campaign ROI are other capabilities that organizations find very useful.

SAP Hybris Marketing provides a personalized experience for customers in the moment when it really matters to them. Customer behavior data, such as profile information, social media posting, website clicks and reviews, is integrated with existing enterprise data to determine the context of customer interaction in real-time, using the computational power of the HANA in-memory platform. As a result, SAP users can easily enable personalization of website content or product recommendations.

The SAP platform is one of the best suited for on-premise large-scale highly customized multi-channel operations as it is capable of tackling the majority of large scale enterprise e-commerce use-cases. Another reason is that the Hybris Omni Commerce Connect (OCC) web services offer a RESTful web services API to make the platform service-oriented.

Mobile & Social

During Dreamforce 2017, Salesforce also announced mySalesforce, the next generation of its Salesforce mobile app. A custom-branded mobile and includes low-code development platform, that makes it easy for anyone to build and publish. It lets businesses build custom Android and iOS apps and list them directly in the App Store and Google Play Store. With its new listing wizard it speeds up publishing, with simplified step-by-step instructions that allow the user to walk through publishing the app, even testing and configuring it beforehand, the release said.

SAP Hybris as a Service, (also known as YaaS), according to SAP, helps businesses rapidly and easily augment and enhance their existing solutions with microservices and software-as-a-service applications. However, Gartner cites: “SAP’s mobile apps to support customer self-service — contextual chat, knowledge management, video and co-browsing (much of it handled by partners), and complex case routing — were not rated highly by its reference customers.”

In 2016, Salesforce acquired Quip, a startup developer of a team-based productivity platform that competes with unified collaboration apps, such as Stride, Microsoft Teams, and Slack, that centralize a team's work and communication in one place.

Later last year, at its annual Dreamforce conference in San Francisco, which included everything from a rapper to the 25 Buddhist monks leading "on-demand meditation" at two mindfulness zones, Salesforce announced that the company will enable its users to use newly released Single Sign-On (SSO) to access Quip with their Salesforce username and password. According to the release, a new Lightning Component for Quip was rolled out to enable teams of employees to access their Quip Living Documents from the Salesforce platform or extend its capabilities into other apps. During Dreamforce 2017, the company announced the Quip Collaboration Platform that introduces dynamic pages called Live Apps, in which teams and users can embed anything from a Salesforce record to a poll, calendar, or full-blown native app into a Quip document to centralize work into one place, Rafael Alenda, Salesforce's Vice President of Marketing for Quip, said this release helps move Quip from a product to a platform: "This platform extends collaboration beyond docs and spreadsheets, and allows teams to collaborate around the apps and tools they use every day but don't put into a document.”

On the other hand, SAP has SAP Jam which is a cloud-based enterprise social networking suite and collaboration app that helps enterprises connect their customers, partners, and employees with key information and process in the cloud. SAP Jam is used by workforces in some vertical industries such as Information Technology, Customer Service, Marketing, Sales, and HR. SAP Jam offers enterprise social networking features such as project collaboration tools, task management, discussions and polls, instant messaging, discussions and chat rooms, document and content sharing, microblogging, and personal profiles. Besides all these, the platform can also provide some personalized recommendations on your homepage and suggestions on content to read based on the groups and people you like and follow, and your activities.

Integration with SAP Cloud for Customer, SAP CRM, and SAP ECC enables immediate ability to kick off a collaborative process directly from the account or opportunity. Problem-solving tools such as pro/con tables and ranking assist in problem-solving and decision making.

Before moving onto the pricing details, here is a visual summary of their pros and cons in the areas:

Pricing for SAP

There are two established products: SAP Hybris Service Cloud (the version for customer service being the multitenant SAP Hybris Service Cloud) and the older, on-premises SAP CRM 7.0 system.

Cloud-based: Monthly subscription fee for each user login.

Contract term: Terms vary based on user needs.

The cloud product comes in Standard, Professional and Enterprise editions.

Recruiting cost: Subscription-based license fees cover maintenance, support and managed services. Fees apply for professional implementation services, such as integrations, customizations and data migration and de-duplication.

On-premise: Perpetual license fee, paid up front, for each user.

Contract term: Perpetual license agreement signed up front to own and use software indefinitely.

Recruiting cost: Perpetual licenses require annual maintenance and support contracts.

Pricing for Salesforce

Salesforce CRM offers four SMB and enterprise pricing plans billed annually. Here are the plans:

Contact Manager– $5/user/month

Contact management for up to 5 users

Group– $25/user/month

Basic sales & marketing for up to 5 users

Professional– $65/user/month

Complete CRM for any size team

Enterprise– $125

Customize CRM for your entire business

Performance– $300

Extend CRM to accelerate performance

A Sales Cloud Lightning and Service Cloud Lightning bundle is also available upon request.

My POV

At the end of the day, there is no single winner of this battle as both can address even very intricate and complicated needs for a CRM system. It depends on business requirements and digital ecosystem. One of the common reasons for utilizing SAP CRM, for instance, is that many enterprises are already using SAP ERP applications as its CRM platform performs seamlessly within an SAP ecosystem due to its robust CRM middleware integration with SAP ECC and BI systems. That being said, in a cloud-based ecosystem, Salesforce shines better for many use cases with respect to cloud integration, software customization, and third-party extensibility.

On the other hand, deciding on your CRM platform is not a decision to be taken lightly as shifting away from both platforms, especially, when you have made significant investments to customize the platform, is troublesome.

If you want every dollar invested on your technology landscape to add value for the consumer or add value for your stakeholders, then some due diligence is definitely needed and can save your business from trouble and financial loss. First, outlining your business goals and needs alongside expectations from a platform may make a great starting point. Once you have a crystal clear vision, then you should do your market research to understand what your options are within the market where everything is moving at a very fast pace. During your due-diligence, there is also one paramount consideration factor that you should always keep in mind: what can change in the next couple of years as your business ramps up. That mindset will lead you to pick a future-proof platform in the end. At the end of the day, buyers should aim for finding the best match rather than simply the best product in order to maximize their every digital investment dollar’s effectiveness.

If you are looking for adding more players to your technology landscape, besides a CRM system, you may also find our free review of top .NET e-commerce solutions beneficial as the report looks at a few of the most popular .NET eCommerce solutions on the market to give you an idea of what features are out there, how much developer support you’ll need for each, and which is best suited for your organization.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.