The State of Cross-Border eCommerce

In 2017, we witnessed a significant amount of international deals and acquisitions made by the biggest marketplaces. Amazon, for instance, bought 100% of the Middle East’s biggest e-commerce player, Dubai-based Souq.com and acquired a retail operation in the region which will immensely assist Amazon in dealing with bureaucratic tasks in the region. On the other hand, China-based Alibaba Group Holding Ltd., a formidable challenger to Amazon, has also been investing in the markets outside of China to expand its footprint across the world. In this article, we will take a closer look at the ever-growing trend in the overseas expansion of online retail and how to make cross-border e-commerce work by outlining advantages and challenges.

biggest marketplaces. Amazon, for instance, bought 100% of the Middle East’s biggest e-commerce player, Dubai-based Souq.com and acquired a retail operation in the region which will immensely assist Amazon in dealing with bureaucratic tasks in the region. On the other hand, China-based Alibaba Group Holding Ltd., a formidable challenger to Amazon, has also been investing in the markets outside of China to expand its footprint across the world. In this article, we will take a closer look at the ever-growing trend in the overseas expansion of online retail and how to make cross-border e-commerce work by outlining advantages and challenges.

In today’s news, another one of China’s e-commerce giants, JD.com, announced that they aim to challenge Amazon in the European market. To that end, JD will invest at least €1bn over two years to build its logistics network in France and open its first European research center that focuses on artificial intelligence and big data in Cambridge in the UK this year. This center will mark JD’s second center outside of China. The reason why they chose Europe for this project has an interesting angle. In an FT interview, JD’s CEO Richard Liu said that the cost of hiring talent specializing in AI was now lower in Europe than in the US and even China. To have a leg up on the competition against Amazon and Alibaba, the company has been developing its differentiating point which is its logistics networks armed with cutting-edge technology. In the Europe market, the brand plans to expand its local partnership for last-mile delivery though. JD has overseas expansion plans not only in Europe but also in North America as they will launch in the US in the second half of this year. As you can see from this example, the cross-border e-commerce play almost feels like a strategy board game where players try to invade as many regions as possible with their figurative soldiers.

If companies are dispensing their budget and resources on this scale to expand globally, one would wonder how big the size of the opportunity is. According to Accenture, by 2020, over 2 billion e-shoppers (or 60 percent of the target global population) would be transacting 13.5 percent of their overall retail consumptions online, equivalent to a market value of US$3.4 trillion (Global B2C GMV, growing at CAGR of 13.5 percent from 2014 to 2020).

Globally, clothes, footwear, and toys are the most popular retail categories bought cross-border. Hotel reservations and airline tickets are the most popular non-durable goods purchased. A majority of cross-border shopping is done via marketplaces and globally, cross-border sales account for nearly one-quarter of third-party units sold on Amazon.

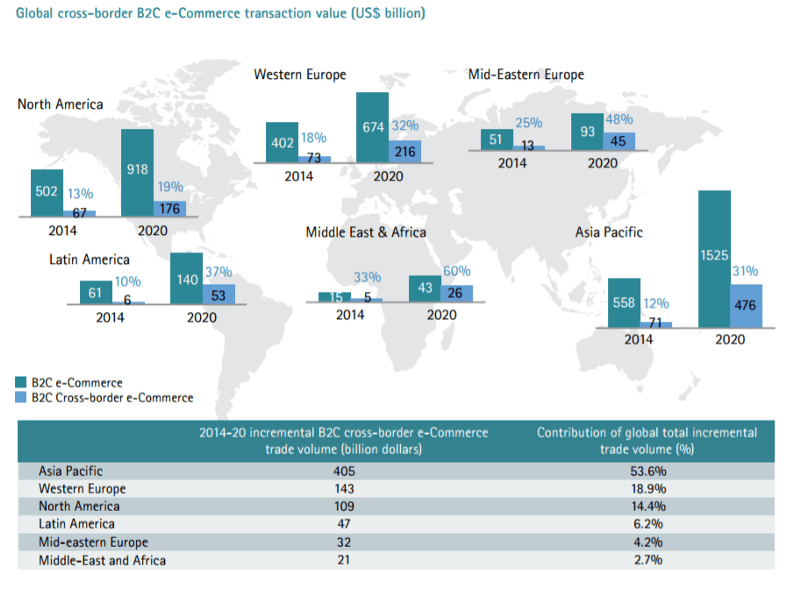

If we break this down into the regions, the Asia Pacific market, dominated by China, will become the largest e-commerce cross-border region for both imports and exports. The region is contributing 53.6 percent of the incremental trade volume over the period of 2014 to 2020. Cross-border e-commerce has been considered the booming backdoor avenue, especially in China. There is pressure from traditional retailers at home being placed on the government to regulate companies overseas.

“If you do not harmonize the rules for commercial imports and cross-border e-commerce, there is an advantage you give to companies overseas,” said Chan Wai-Chan, a retail partner at consultancy Oliver Wyman in Hong Kong. Companies that have invested in a brick-and-mortar presence in China feel as though they’re being usurped by businesses that haven’t gone through the same expense of setting up shop, he said.

Accenture predicts that more than 200 million Chinese will be cross-border shopping by 2020, with a transaction volume of imported goods purchased online reaching $245 billion.

According to Accenture’s data, Western Europe and North America are trailing at 18.9 percent and 14.4 percent respectively; near-shore B2C transactions among EU countries is the driver behind a relatively high cross-border component in Western Europe.

The Middle East is on the verge of a massive digital disruption with significant untapped e-commerce potential. In the Middle East and North Africa region, half of all e-commerce purchasing is cross-border, according to KPMG, the accounting and consulting firm. There is a unique value of the region for online retailers as the market is expected to significantly outpace the growth of the global luxury goods market in the next five years. This means that in this particular region, with cross-border e-Commerce, B2C consumers are seeking values beyond bargains. Seen together with the far-reaching potential of e-commerce in the region, Amazon’s entry into the market can shake things up and will lift the game.

Mexico is another emerging market when it comes to e-commerce. In fact, a Forrester report cited that Mexico was due to see increased sales of 150 percent between 2013 and 2018, going from $2.2 billion to $5.5 billion. In recognition of the region’s increasing potential, Amazon didn’t waste time and in 2015, the e-commerce giant launched Amazon.com.mx which is a Spanish-language site featuring millions of items including consumer electronics, kitchen and home items, sports equipment, tools, baby items, health and much more. In conjunction with the launch of the site, Amazon also introduced its online selling service for Mexican businesses and sellers alongside its Fulfillment by Amazon service.

Amazon’s investments in India have been changing the landscape of the competition in the region which generated around $14-14.5 billion in e-commerce sales in 2016. The company has invested $2 billion in the Indian market and is planning to invest $3 billion more. Flipkart and Snapdeal lost ground to Amazon thus there have been rumors flying around saying that Flipkart and Alibaba-backed Paytm are in talks with Snapdeal, for a possible merger. “India is an important market for Amazon, not only because of the potential size of e-commerce in the country but also due to Amazon’s failure in China to become a meaningful player,” said Colin Sebastian.

Challenges of Expanding Overseas

Despite an abundance of opportunities, there are many challenges in the cross-border e-commerce market such as market-entry, law and regulations, logistics, and localization.

When online retailers go global, they often face currency concerns. The unexpected shipping charge category is already the highest source of shopping cart abandonment with 28 percent. When the currency concerns are thrown into this equation, the issue of unexpected shipping cost is emerging even more.

Online retailers cannot rely on browser-based translations as they are still performing very poorly. On the other hand, more than 6,500 languages are spoken around the world. Many studies find that consumers increasingly prefer to learn, shop, and transact in their native language. As a bilingual and a non-native English speaker, I definitely agree that interacting with your customers in their native language has a huge impact on decision making and, more importantly, brand loyalty. However, it is not an easy task for brands to execute a consistent marketing program across different regions. In the Chinese market, for instance, it is very important to find people who have a strong enough understanding of both Chinese and western culture to navigate delicate business negotiations. Not only communication but also business models vary across countries. A business model that serves well in one country is not necessarily applicable to others.

In a CMS-Connected interview, SDL CMO Peggy Chen gave some actionable recommendations for brands that want to tackle brand loyalty with today’s digitally-savvy and demanding customers: “To cultivate brand loyalty, first, you have to think about your global strategy. That has to be thought about holistically and in advance. You can’t think about globalization after your execution. If your goal is to reach x number of the market in Y amount of time, you have to plan it out in the beginning. It means that as you’re building your product, you should make sure that you have a plan for how you’re going to globalize all of your product with various languages. Let’s say that you are launching a campaign that has a multimedia capability so you have a video regarding your product launch. The assets of the video can even differ, depending on the market. A color, for example: in the US, green conveys a more positive message whereas red is perceived as passion. However, in the Asia-pacific market, red doesn’t have the same impact, conversely, it is traditionally a symbolic color of happiness. So when you’re localizing your content you should consider not only the words but also the visual and vocal aspects of your campaign. In that regard, we also have an entire globalization consulting organization which specializes in helping companies localize their content with the various languages.”

for brands that want to tackle brand loyalty with today’s digitally-savvy and demanding customers: “To cultivate brand loyalty, first, you have to think about your global strategy. That has to be thought about holistically and in advance. You can’t think about globalization after your execution. If your goal is to reach x number of the market in Y amount of time, you have to plan it out in the beginning. It means that as you’re building your product, you should make sure that you have a plan for how you’re going to globalize all of your product with various languages. Let’s say that you are launching a campaign that has a multimedia capability so you have a video regarding your product launch. The assets of the video can even differ, depending on the market. A color, for example: in the US, green conveys a more positive message whereas red is perceived as passion. However, in the Asia-pacific market, red doesn’t have the same impact, conversely, it is traditionally a symbolic color of happiness. So when you’re localizing your content you should consider not only the words but also the visual and vocal aspects of your campaign. In that regard, we also have an entire globalization consulting organization which specializes in helping companies localize their content with the various languages.”

The good news is today, there are many e-commerce platforms available on the market that help merchants develop territory-specific versions of their sites and are enabled to localize the language, currency and shipping solutions for international buyers. Therefore, it is important to choose the right e-commerce platform before taking the leap.

The poorly targeted region can create a headache. Just because the cross-border e-commerce market is emerging doesn’t mean all countries are full of potential as there are some countries that haven’t warmed up to cross-border e-commerce just yet. Unless an online retailer has a different internal mission or data, it is not a smart move to jump into those territories. Therefore countries with high online shopping transactions like China, Singapore, Australia and Canada are the attractive places as they have the most driven international buyers based on research studies.

My POV

As global markets are becoming increasingly diverse and connected, the demand for technology innovation in this space does not seem to be impaired anytime soon. Therefore, while online retailers are looking for new ways of capturing this major window of opportunity, technology providers are beefing up their commerce and globalization capabilities to help merchants satiate consumers interests in foreign-manufactured and exotic products.

It is important to have a thorough but nimble plan before jumping into the pool of cross-border commerce opportunities as bad experiences easily can result in an aggravated customer. When that happens right off the bat, it is really hard to turn a bad reputation in the new market around without harming the brand. Developing a great strategy may take time thus it can cause a later entrance into the market but its strength will make up for the time lost as it will help to maximize the impact of the investment.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.