Worldwide IT Spending to Hit $3.7 Trillion in 2018

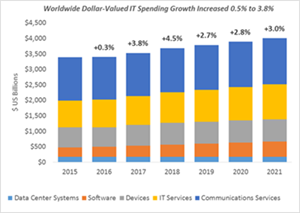

Every year, Gartner releases a report on the annually worldwide IT spending predictions, and  every quarter, the market research firm publishes a quarterly update on those spending figures. With this in mind, according to Gartner’s latest report, worldwide IT spending is projected to total $3.7 trillion in 2018, an increase of 4.5 percent from 2017. Gartner's forecast for 2018 worldwide dollar-valued IT spending growth has been revised up 0.2% to 4.5% due to the continued decline of the U.S. dollar against other currencies. The Stamford, Conn.-based research firm warns multinational technology product management leaders to hedge against further currency fluctuations in 2018.

every quarter, the market research firm publishes a quarterly update on those spending figures. With this in mind, according to Gartner’s latest report, worldwide IT spending is projected to total $3.7 trillion in 2018, an increase of 4.5 percent from 2017. Gartner's forecast for 2018 worldwide dollar-valued IT spending growth has been revised up 0.2% to 4.5% due to the continued decline of the U.S. dollar against other currencies. The Stamford, Conn.-based research firm warns multinational technology product management leaders to hedge against further currency fluctuations in 2018.

"Global IT spending growth began to turn around in 2017, with continued growth expected over the next few years. However, uncertainty looms as organizations consider the potential impacts of Brexit, currency fluctuations, and a possible global recession," said John-David Lovelock, research vice president at Gartner. "Despite this uncertainty, businesses will continue to invest in IT as they anticipate revenue growth, but their spending patterns will shift. Projects in digital business, blockchain, Internet of Things (IoT), and progression from big data to algorithms to machine learning to artificial intelligence (AI) will continue to be main drivers of growth."

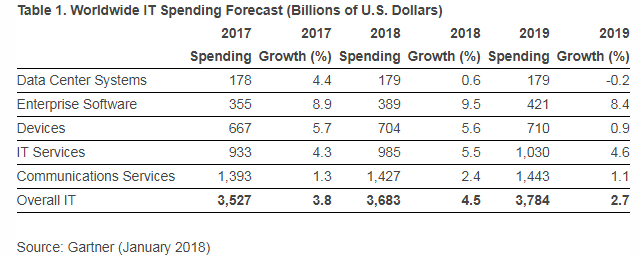

From an economic perspective, it is great to hear that technology buyers won’t put their hands back in their pockets. However, the main reason I am interested in these reports is to see the pattern in growing technologies as Gartner does not only publish the overall predicted number but also IT spending forecasts by category, although the categories are quite broad. Here’s the table from Gartner’s report illustrating the biggest five areas of IT spending:

Data Center Systems

The data center systems segment will see the smallest growth and the steepest fallout in growth among all the categories featured in the table as spending on this segment will be only 0.6% in 2018 to $179 billion. The shift towards software-defined storage and cloud delivery drove the server markets in Greater China and Western Europe and accelerated interest in the North American enterprise network equipment market in 2017. As Gartner predicted in its report published in 2016, in the long run, organizations are expected to decrease spending on data center systems.

Enterprise Software

The continuous strong growth in the enterprise software segment came as no surprise to me. In 2018, the spending on enterprise software will jump 9.5% in 2018, and it will continue to represent a strong growth with another 8.4% in 2019 which will bring it to a total of $421 billion. North America is the dominant regional driving force behind the growth.

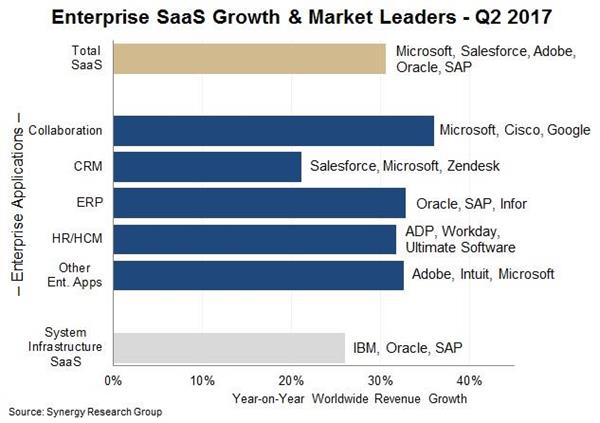

One of the primary factors behind this strong growth is the increasing availability of a cloud-based pricing model which is applicable for systems with a cloud deployment model, also known as Software-as-a-Service (SaaS) or Web-based software, hosted on the vendor’s or service provider’s servers. Users access the software through any device that is compatible with the system and has an Internet connection. Due to its reduced upfront costs, flexibility and easy implementation, the entire software industry has seen a cautious shift towards cloud-based implementation and the SaaS (software as a service) model in recent years.

When it comes to the spending enterprise software, customer relationship management (CRM) has been one of the fastest-growing markets. Traditional enterprise software vendors like Microsoft, SAP, Oracle, and IBM still have a huge base of on-premise software customers and they are all now pushing to aggressively convert those customers to a SaaS-based consumption model like Salesforce.

Another underlying trend in this category is the emergence of new, consumer-grade enterprise applications that address critical business needs and use cases in the vertical industries such as human resources and finance. If you are interested in hearing more about the trends and predictions on enterprise software, I highly recommend that you check out another CMS-Connected article entitled The ECM Market: What Happened in 2017 & What's Next in 2018 as the industry veterans share their thoughts on what will drive the enterprise content management market this year.

Devices

2017 was the year of resilience for devices sales as the segment experienced growth for the first time in two years with an increase of 5.7%. Devices sales are expected to continue to see a solid growth with worldwide software spending projected to grow 5.6% in 2018. The reason behind the reduction in end-user spending was mostly about the lackluster economic issues in Russia, Japan, and Brazil. However, this year, end-user spending on mobile phones is expected to increase marginally as average selling prices continue to creep upward even as unit sales are forecast to be lower.

Gartner claims that the releases of the iPhone 8 and iPhone X didn’t impact the market in 2017. That being said, in 2018, iOS shipments are expected to grow 9.1%. In the case of personal computers (PCs), two years back, Gartner noted that Windows 10 upgrades would lead to further PC buying delays, as consumers would be willing to “use older PCs longer, once they are upgraded to Windows 10”. Now that the Windows 10 migration has started, the Stamford, Conn.-based research firm expects it to drive positive growth in the business market in China, Latin America and Eastern Europe but overall, personal computer growth is expected to be flat in 2018.

IT Services

The spending on the IT services segment makes up one of the heavy-weight components of IT budget and will jump 5.5% in 2018 to $985 billion. IT services mostly include consulting and advisory services and the growth in this segment is typically driven by the markets that transform their businesses and upgrade their technologies. Japan represents one of those markets, for instance.

Communication Services

Communications services is taking up the biggest slice of the IT spending pie for 2018. Communication services spending is expected to reach a total of $1,427 billion in 2018, with an increase of 2.4%. Considering the wide adoption of mobile in the region, I assume, Greater China will probably add the most dollars to spend on telecommunication services. One also would wonder whether this prediction is tied to the projected increase in devices as well.

2018 IT Spending will Be Driven by AI, Blockchain, and IoT

Although in the report, Gartner mostly built its IT spending predictions across the hardware,  software, IT services, and telecommunications segments, the research vice president Mr. Lovelock pointed out that growing technologies such as AI, Blockchain, and IoT will have a huge impact on future iterations in the forecast.

software, IT services, and telecommunications segments, the research vice president Mr. Lovelock pointed out that growing technologies such as AI, Blockchain, and IoT will have a huge impact on future iterations in the forecast.

"Looking at some of the key areas driving spending over the next few years, Gartner forecasts $2.9 trillion in new business value opportunities attributable to AI by 2021, as well as the ability to recover 6.2 billion hours of worker productivity," said Mr. Lovelock. "That business value is attributable to using AI to, for example, drive efficiency gains, create insights that personalize the customer experience, entice engagement and commerce, and aid in expanding revenue-generating opportunities as part of new business models driven by the insights from data."

"Capturing the potential business value will require spending, especially when seeking the more near-term cost savings. Spending on AI for customer experience and revenue generation will likely benefit from AI being a force multiplier — the cost to implement will be exceeded by the positive network effects and resulting in an increase in revenue," said Mr. Lovelock.

Mr. Lovelock is not the first AI optimistic Gartner analyst as one of the recent Gartner reports claimed AI will create 2.3 million jobs in 2020 while eliminating 1.8 Million. To make it even industry-specific, Gartner analysts suggest that through 2019, healthcare, the public sector, and education will see continuously growing job demand while manufacturing will be hit the hardest. Starting in 2020, AI-related job creation will cross into positive territory, reaching two million net-new jobs in 2025.

My POV

Digital innovation is driving the move to bring together the organization's own systems and contributions from outsourcers and "as a service" providers. I have been making this argument for a while now and believe that in 2018, integrating ecosystems of people, business, and things will accelerate IT spending worldwide as many organizations are already on the cusp of a paradigm shift in perspective to develop the right platform ecosystem.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.