Explained: Forrester's Wave for Midmarket B2B Commerce Suites

Whether it is one of the Global Fortune 500 companies or a midsize company in the $10M - $500M range, the expectation of today’s modern consumers is to receive an enterprise-level experience. As being able to deliver this type of an experience is becoming a table stake, more and more midmarket B2B organizations are finding themselves in a situation where they have to keep up with very large enterprise B2B and B2C companies. Many businesses, even in the upper mid-market or lower enterprise market, on the other hand, typically don't have those technical and financial resources to adopt the leading enterprise B2B and B2C commerce suites. As a result, the demand for enterprise-grade experiences is driving midmarket B2B firms to adopt commerce platforms that offer enterprise-quality commerce technology at a small-business price. According to Forrester, companies will spend $2.4 billion on B2B commerce platforms by 2021, of which just over $1 billion will be spent on midmarket B2B commerce platforms alone. Therefore, Forrester created a new Wave, entitled The Forrester Wave: B2B Commerce Suites for Midsize Organizations, to evaluate B2B commerce suites with an ability to deliver enterprise-quality features at a lower total cost of ownership (TCO) and faster time-to-market (TTM).

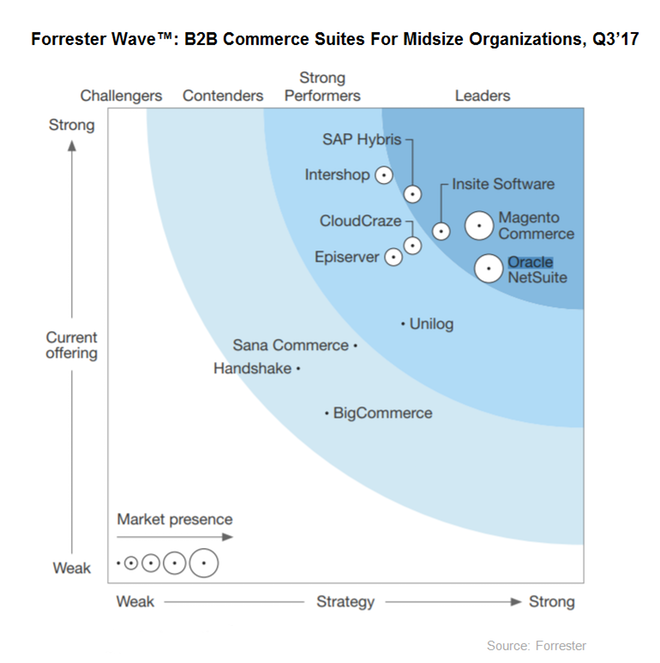

In the report, the market research firm evaluated 11 vendors on 35 criteria, grouped by Current Offering, Strategy and Market Presence. Below are how those platforms stack up in the report:

-

Leaders: Magento Commerce, Oracle NetSuite, SAP Hybris, and Insite Software

-

Strong Performers: Intershop, CloudCraze, Episerver, and Unilog

-

Contenders: Sana Commerce, Handshake, and BigCommerce

In this article, besides what makes some of these vendors featured in the report significant, you will also read in-depth insights from some vendors’ leadership shared with CMS-Connected on what sets their platform apart and where they think we will see the most innovation in the coming months:

Who’s On the Crest of Forrester's Wave for Midmarket B2B Commerce Suites

Magento Commerce Offers an Open, Feature-Rich Solution

In November 2015, Magento announced that it had launched as an independent company, backed by the Permira funds, four years after its acquisition by eBay, Inc. Mark Lavelle, formerly senior vice president at eBay Enterprise, was appointed to lead the company as its new CEO. In April 2016, the open source e-commerce platform provider rolled out its first cloud-based service, Magento Enterprise Cloud Edition. With facilitating around $124 billion in transactions and having over 250,000 merchants on board, Magento has become one of the most popular self-hosted commerce platforms.

Speaking to CMS-Connected ahead of Forrester’s recognition, Mark Lavelle, CEO of Magento  Commerce stated: “We are extremely proud to be named a leader in the Forrester Wave B2B Commerce Suites for Midsize organizations. This is a strong third-party validation of the strength of our open, cloud-based platform in equipping mid-to-large size enterprises with the powerful, out-of-the-box B2B functionality they need to handle complex B2B requirements.” Lavelle also added: “Magento has a long track record of success in B2B commerce and enabling merchants to simply and cost-effectively adapt business models to meet the needs of today’s digitally connected B2B buyer, as well as to quickly extend native functionality like personalization and site search through Magento Marketplace to meet the precise needs of their business.”

Commerce stated: “We are extremely proud to be named a leader in the Forrester Wave B2B Commerce Suites for Midsize organizations. This is a strong third-party validation of the strength of our open, cloud-based platform in equipping mid-to-large size enterprises with the powerful, out-of-the-box B2B functionality they need to handle complex B2B requirements.” Lavelle also added: “Magento has a long track record of success in B2B commerce and enabling merchants to simply and cost-effectively adapt business models to meet the needs of today’s digitally connected B2B buyer, as well as to quickly extend native functionality like personalization and site search through Magento Marketplace to meet the precise needs of their business.”

In the report, Magento Commerce’s latest release, V2.2 has been evaluated. To read Forrester analysts Andy Hoar’s full comment on the platform, you need to purchase the report, however, let me give you a glimpse into his analysis. Hoar views the platform as “a best fit for companies that want an open, feature-rich solution that they can extend easily and inexpensively.” With the updated version of Magento Open Source 2.2 release, the Campbell, California-based vendor enhanced its B2B feature set, advanced its reporting module, made significant enhancements in platform security and developer experience, and improved indexing, cart, and cache operations. The company claims that more than 60% of Magento merchants are using the platform to sell to both businesses and direct to consumers.

What is the Secret Sauce in SAP Hybris’s Success?

Founded in 1997 and acquired by SAP in 2013, SAP Hybris has been utilized by many internationally recognized organizations, including Samsung, O2, Vodafone, Procter and Gamble, GE, Toys “R” Us, and Audi. Following the release of this newly created Forrester Wave report, I reached out to Riad Hijal, Global VP, Omni-Channel Commerce Solution & Strategy, SAP Hybris, first, to pick his brain on how SAP Hybris intends on keeping up this momentum: “SAP Hybris Commerce was recognized earlier this year by Forrester as the only commerce leader in both B2B and B2C for the Enterprise market segment. That recognition combined with SAP Hybris’ most recent position in the Forrester Wave Report on B2B Commerce Suites for Midsize Organizations, speaks to the strength of SAP Hybris’ commerce solutions. Through these accolades, Forrester’s validation of SAP Hybris’ strategy in the commerce market helps solidify our position as the undisputed commerce market leader across segments. Historically, Hybris began as an e-commerce company, so our momentum in this market aligns with our organic roots. The “secret sauce” in SAP Hybris’ success resides first and foremost in its unwavering commitment to an innovation-centric approach to commerce. Moving forward, SAP Hybris will continue focusing on delivering innovations that our customers can easily consume to grow, differentiate, and transform their businesses with agility.”

Hybris’ most recent position in the Forrester Wave Report on B2B Commerce Suites for Midsize Organizations, speaks to the strength of SAP Hybris’ commerce solutions. Through these accolades, Forrester’s validation of SAP Hybris’ strategy in the commerce market helps solidify our position as the undisputed commerce market leader across segments. Historically, Hybris began as an e-commerce company, so our momentum in this market aligns with our organic roots. The “secret sauce” in SAP Hybris’ success resides first and foremost in its unwavering commitment to an innovation-centric approach to commerce. Moving forward, SAP Hybris will continue focusing on delivering innovations that our customers can easily consume to grow, differentiate, and transform their businesses with agility.”

While the Forrester Wave authors view the platform as a best fit for companies looking for an industrial-strength commerce platform, the market research firm also cited the feedback received from the SAP Hybris users, claiming that the Standard Edition cloud version lacks key functionality such as omnichannel order management (OMS), an assisted service module, and a product catalog. Therefore, I wanted to inquire with Hijal if there are future plans or ongoing projects to address this growth opportunity. Here’s what he had to say:

“SAP Hybris’ primary strategy for the midmarket is to effectively help our customers focus on growing and differentiating their business with easy to use, best-of-breed capabilities. This allows SAP Hybris to take a run and maintain the platform so business leaders can focus on more strategic tasks. Specifically, the SAP Hybris Commerce Cloud Standard Edition provides the capabilities most typically required by midmarket customers to achieve that growth goal. The report also mentioned that SAP Hybris enables customers to seamlessly transition from Standard to Professional Edition which provides omnichannel order management (OMS), assisted service module, and the ability to sell subscription products, among other capabilities. Because both editions are based on the same product and code line, customers do not have to worry about changing platforms as their business grows or as their needs evolve. They can continue to focus on what they do best: running and growing their business.”

Lastly, due to his expansive experience in the space, I wondered about what trends he sees on the horizon. “The trends of artificial intelligence (AI) and machine learning are increasingly being infused into front-end and back-end operations to ensure consistent, contextualized customer experiences. Aligning with this trend, conversational commerce is taking off as it enables users to streamline the buying process. This is done by quickly responding to any last minute questions that left unanswered could potentially halt or stall the purchase decision. We expect to see an influx of vehicles that enable this such as chatbots, virtual concierges, and digital/virtual assistants. However, these capabilities will only be made possible through integration with a modern, agile, and API-enabled commerce platform such as SAP Hybris Commerce,” Hijal told me and added: “From a business perspective, enterprises are shifting their models to prepare for the outcomes-based economy. In this environment, customers will evaluate companies based on the overall experience they receive vs. a one-off offering they purchase from the brand. To meet these increasingly demanding needs, organizations have been transitioning to a subscription service model because it arms them with immense amounts of customer data that can be analyzed for hyper-personalized interactions as well as provide a stable revenue stream.”

Before moving onto Oracle NetSuite, here’s a fun fact from Francis Hart's article on SAP Hybris; between 2012 and 2015, 58% percent of organizations that phased out their Demandware platform migrated to SAP Hybris whereas 34% of organizations that phased out their Magento adopted SAP Hybris.

Oracle Netsuite: The Transition from On-Premises ERP to Saas

On July 28, 2016, Oracle announced that it had entered into a definitive agreement to acquire SaaS ERP provider NetSuite. At $9.3 billion, the deal is the largest SaaS acquisition to date. However, the acquisition was the least shocking acquisition news in the history of enterprise software. Following the announcement of the deal, "It’s like the high school sweethearts you always knew would get married but they had to get through four years of college first," said Frank Scavo, President of Strativa.

Nineteen-year-old NetSuite is a very well established company in the cloud enterprise resource planning (ERP) space by helping organizations track supply and demand, inventory, accounting, customer relationships (CRM), and HR. Adding Netsuite to the fray helped Oracle not only play catch up with its rivals that specialize in cloud-based offerings but also gain some additional competitive edge in taking on their rivals as NetSuite enables Oracle to reach out to smaller sized companies than its traditional clientele. Therefore, after the acquisition, NetSuite’s multitenant SaaS SuiteCommerce Advanced solution, which was evaluated in the report, marketed to the small and medium-sized businesses, whereas Oracle Commerce Cloud was targeting enterprise customers. NetSuite's cloud approach also plugged the holes in Oracle's cloud offerings, including manufacturing, retail, commerce, and professional services, all of which are areas Oracle was serving with an on-premises model, prior to the acquisition.

Another takeaway I retrieved from Oracle NetSuite’s placement in the Wave is that the transition from on-premises ERP to SaaS is now becoming mainstream.

Insite Is “Very Responsive To Client Needs”

Insite Software has been named as a Leader in the Forrester Wave and was described as having a strong vision for a unified value proposition that includes eCommerce and salesperson- centric and persona-driven selling. As far as its customer service goes, the vendor received kudos from its users as being “very responsive to client needs.” That being said, the market research firm also noted that the Minneapolis-based vendor needs to evolve its offerings, especially, in dynamic personalization technologies and PIM.

Intershop, CloudCraze, Episerver, & Unilog are Making Waves

While Intershop, CloudCraze, Episerver, and Unilog have been named as strong performers in the report as they “offer competitive options,” Episerver, specifically, scored highest among all vendors in experience management. Knowing Episerver lately has been amplifying its commerce capabilities, I reached out to James Norwood, Executive Vice President Strategy, CMO at Episerver, to inquire his take on what Episerver has done to contribute to its placement in the Wave and how the vendor intends on keeping up that momentum. “Episerver offers a  tightly unified content and commerce platform, which Forrester recognized as an ideal fit for B2B manufacturers, particularly those going direct to consumer, and distributors looking to deliver content-rich and contextual commerce experiences. The Forrester evaluation really drove home our commitment to experience-driven commerce, and we are continuing to invest in both partnerships and new capabilities that will empower our customers to deliver seamless buying experiences across touchpoints and channels,” said Norwood.

tightly unified content and commerce platform, which Forrester recognized as an ideal fit for B2B manufacturers, particularly those going direct to consumer, and distributors looking to deliver content-rich and contextual commerce experiences. The Forrester evaluation really drove home our commitment to experience-driven commerce, and we are continuing to invest in both partnerships and new capabilities that will empower our customers to deliver seamless buying experiences across touchpoints and channels,” said Norwood.

Even though Forrester’s Andy Hoar views the platform as a best fit for midmarket companies looking for a CMS-driven solution with tightly integrated commerce capabilities, the market research firm also cited feedback received from Epi users, noting that “customers reported some difficulties with third-party integrations with some PIM and ERP vendors.” In the light of this comment, I wanted to learn more about Episerver’s stand on addressing this issue. Here’s what James Norwood shared with us: “Episerver’s platform provides a modern REST-based API and micro-services architecture, and a series of certified connectors to add-on systems, which supports quick deployment and allows users to quickly integrate an existing line of business systems, including PIM, ERP, and CRM systems. And with the recent release of Episerver Commerce for Dynamics 365, the platform also provides an end-to-end solution that natively provides the CRM and ERP capabilities of Microsoft’s Dynamic 365 in the Azure cloud -- which allows users to plug and play so to speak with very little need for complex integrations or implementations. It is understandable, of course, that on occasion there will be an ERP or PIM system for which we don’t have a standard connector or some customizations require more advanced technical expertise and therefore a longer implementation time, especially when you consider ERP systems, but overall, we pride our platform on its ease-of-use, and this particular evaluation itself noted that customers praised its flexibility and user-friendly interfaces and templates for B2B workflows.”

Last but not least, James Norwood also shared his thoughts on where we will see the most innovation in the coming months: “The commerce ecosystem is becoming more complex every day, and we think brands are starting to understand that it’s not as simple as ‘online vs. brick-and-mortar.’ There are new, disruptive channels cropping up all the time, such as conversational assistants, and to keep up, marketers and merchandisers must be agile. The ‘set-it-and-forget-it’ mentality no longer cuts it. That being said, content is still king on every channel, and the content that matters most to consumers is increasingly visual and interactive, which has given rise to a lot of conversations in the industry about visual commerce, which is definitely the next frontier, and why capabilities like user-generated content and seamless content delivery are so crucial now.”

My POV

In the age of technology, the right e-commerce platform is becoming mission critical for your business to flourish. For that reason, doing your due-diligence can save your business from trouble and financial loss. While doing so, it is also imperative to consider what can change in the next couple of years and choose a platform with which you can ramp up functionality as your business scales. At the end of the day, buyers should aim for finding the best match rather than simply the best product in order to maximize their every digital investment dollar’s effectiveness. You may also find our free review of top .NET e-commerce solutions beneficial as the report looks at a few of the most popular .NET eCommerce solutions on the market to give you an idea of what features are out there, how much developer support you’ll need for each, and which is best suited for your organization.

When it comes to the future of B2B commerce, I definitely agree with James Norwood on finally changing misconception about looking at the space only as ‘online vs. brick-and-mortar.’ Today, we see that the line between offline and online environments is getting blurrier. In fact, the study I recently reported on actually suggests that “offline marketers are increasingly turning to search, social and in-app marketing to drive in-store sales,” whereas “online marketers have increased their investments in television, print and outdoor channels with the realization that those channels are not only too big to ignore but offer sophisticated targeting options.” Therefore, without linking online marketing with offline sales, a claim on delivering personalized experiences “across all channels” remains vague for many businesses.

Due to emerging end customers’ needs, the market still presents enormous opportunities for nimble and innovative vendors. One of those innovation opportunities lies in conversational commerce, as Riad Hijal mentioned. Conversational systems are designed to help businesses maintain the feeling of connection as well as eliminate wait times, dropped calls, and lost tempers. Due to its obvious benefits, many more enterprises are making strategic bets on conversational, bot-powered services as the next vehicle for business interactions to drive better customer and employee engagement.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.